SEIS Tax ReClaim

UK Tax Relief

To stimulate and support entrepreneurship, Her Majesty's Revenue and Customs (HMRC) offers tax incentive schemes for UK taxpayers who invest in qualifying early-stage and growth-focused businesses which have permanent establishments in the UK. Please note that investors who are not UK taxpayers are unable to take advantage of these schemes and the schemes are subject to change.

SEIS

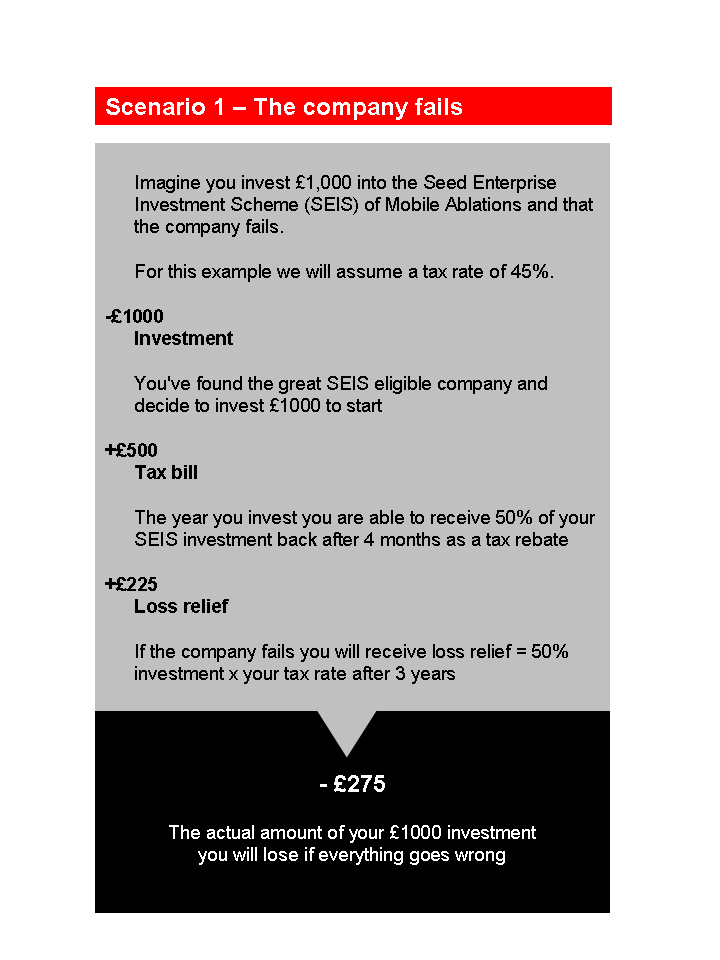

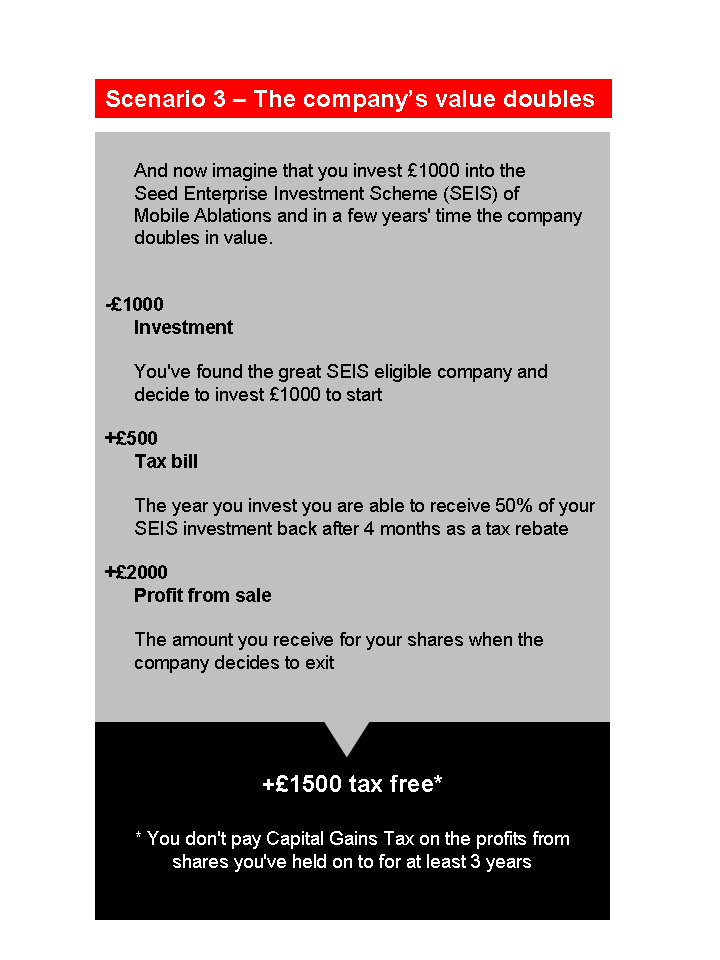

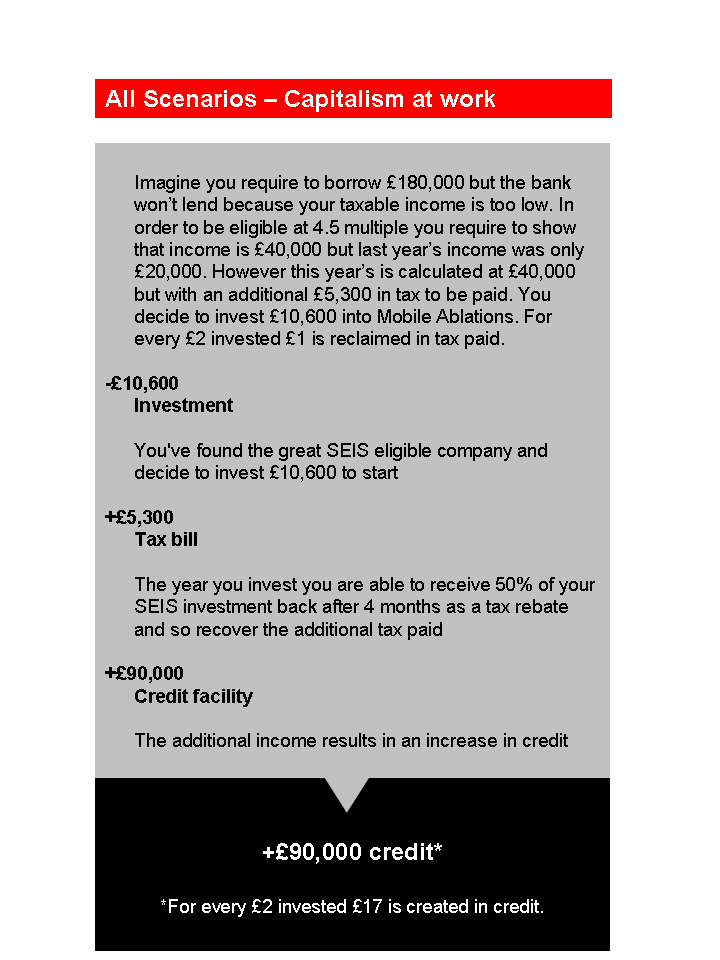

The Seed Enterprise Investment Scheme (SEIS), encourages investment in qualifying new seed-stage startups companies by providing individuals with 50% of their investment back in the form of an income tax repayment from HMRC around 4 months after share purchase and a further income tax repayment of up to around 50% after the shares are kept for 3 years.

Essentially the UK Government is funding your investment by allowing you to reclaim your tax previously paid or due to them.

Plus, investors can benefit from 50% capital gains tax relief on gains which are reinvested in SEIS eligible shares. Any gain arising on the disposal of the shares may also be exempt from capital gains tax, and loss relief is available if the disposal results in a loss.

For investors who realised capital gains during the tax year, SEIS reliefs allow you claim up to:

- 78% of your investment back if the startup succeeds and keeping the shares – and you pay no CGT when you sell your shares; or

- 100.5% of your investment back if the startup fails – allowing you to invest in startups with the potential of full downside protection.

If you realised capital gains during the following tax year, SEIS and related reliefs allow you claim up to:

- 64% of your investment back if the startup succeeds – and you pay no CGT when you sell your shares; or

- 86.5% of your investment back if the startup fails – significantly reducing any losses you incur when investing in startups.

UK tax payers should note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. To learn more about how SEIS or EIS works, please read the online HMRC guidance or contact your professional tax advisor.

“You don’t pay taxes–they take taxes.”

Shares for Life

By purchasing these shares you will become a Shareholder in this medical healthcare company and..

£5.00 Ex Tax: £5.00